Bitcoin & Ethereum 2025: A Year in Review and 2026 Outlook

As we roll into a new year, we want to say thank you to our MyBTC.ca clients from across the country from coast to coast. It doesn’t matter if you buy a little at a time or place larger orders, your trust is what keeps MyBTC.ca moving. And if your goal is to buy Bitcoin in Canada (or sell it) with reliable human support, 2025 was a year that reminded everyone why service and security matter as much as the price.

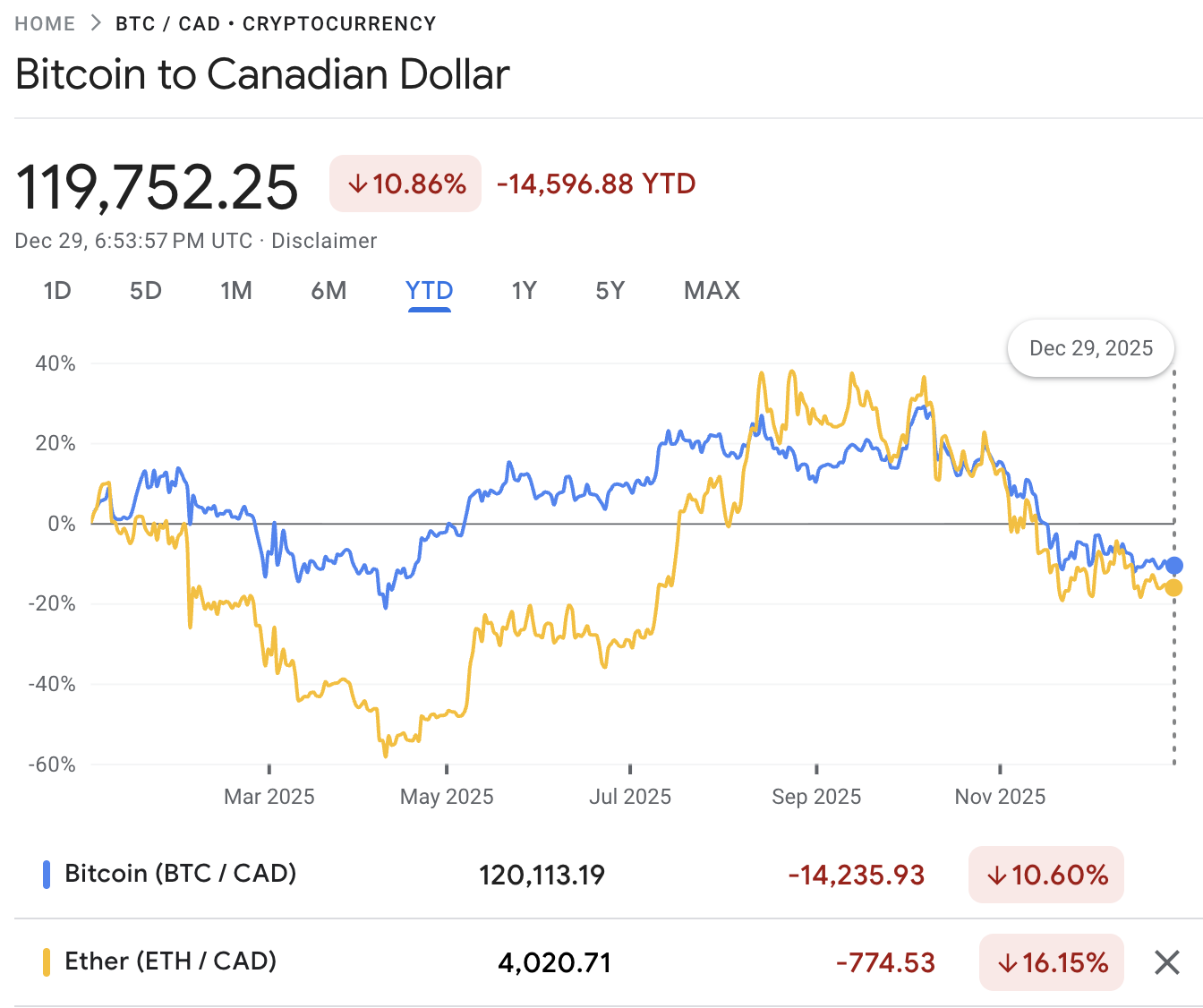

2025 on the chart: a bruising year, not a broken one

If you’re looking at the year-to-date picture for Bitcoin (BTC/CAD) and Ethereum (ETH/CAD), it wasn’t a smooth ride. The snapshot shows both assets set to be finishing the year down double digits in Canadian dollars. That can sting, especially for newer buyers who came into the game near all-time highs.

Still, a down year doesn’t erase the broader story. Crypto has always moved in cycles. Sharp rallies, hard pullbacks, then long periods where patient holders get rewarded. Many long-time Bitcoin buyers don’t view volatility as “bad.” It’s part of what you accept in exchange for exposure to an asset with a long history of major multi-year uptrending movement.

This is one reason “zooming out” matters. If you’ve been around for more than one cycle, you’ve seen years where declines were far deeper than 10 to 16%. Compared to those, 2025 looks more like a reset than a wipeout.

The mainstream kept moving forward, even when price didn’t

One of the most important themes of 2025 was that the plumbing got stronger even while prices fell somewhat substantially. Still, neither Bitcoin nor Ether died. Not even close. Globally, institutional involvement kept building, and the market continued shifting toward regulated access points and added longer-term holders. Some outlets summed up late in the year trading as a slump that cooled earlier optimism, yet still pointed to the growing role of large players and broader adoption over time.

On the Ethereum side, the story wasn’t only “price.” Ethereum continued progressing on scaling and usability. The Ethereum Foundation highlighted the Fusaka network upgrade scheduled for December 3, 2025, describing it as another step in Ethereum’s scaling roadmap following Pectra earlier in the year.

Upgrades like these matter because they target what users actually feel: cost, speed, and reliability.

What Canadians seemed to want in 2025: convenience + control

Looking through the lens of retail behaviour, 2025 reinforced a few patterns we see often:

• More people want speed. When the market swerves, people want to act quickly so they can buy and sell cryptocurrency at a moment’s notice.

• More people want self-custody options. Buying and sending to a personal wallet remains a common preference, although many still place much trust in centralized wallets/exchanges, perhaps unaware of the risk exposure of doing such.

• More people want real support. When something goes wrong (bank holds, verification issues, deposit delays), responsive human help is a real differentiator.

That’s the piece we never take for granted at MyBTC.ca. Crypto runs 24/7/365, and questions do too. That’s why we’re here to help before, during and after your purchase or sell order is complete.

2026 outlook: what we’re watching

We can’t predict the markets and no one can promise an “easy” year ahead, but here are a few grounded themes to watch as we head into 2026:

1) Macro conditions may drive crypto mood

Crypto tends to move with liquidity and risk appetite. When money is tight or markets get cautious, speculative assets often cool off. When conditions loosen, crypto can move fast, as we’ve seen in the past.

2) Bitcoin’s long-term narrative stays intact

Even commentary that focused on 2025’s disappointment still framed the pullback as a sentiment and liquidity story, not a thesis collapse. Bitcoin remains the benchmark asset for the whole sector, and it often leads recoveries when sentiment flips.

3) Ethereum’s progress leans on usage, not hype

Ethereum’s upgrades and scaling roadmap continue to aim at real-world throughput and better user experience. The Fusaka announcement is part of that ongoing work. If on chain activity and practical applications keep growing, that’s a tailwind even if the price isn’t as sexy as Ether-believers would like at the time.

A quick note to long-term holders (and new buyers)

If 2025 taught anything, it’s that patience is still a skill in crypto. Catching positive short-term results can be frustrating during pullback times. Yet many people who consistently buy Bitcoin in Canada do so with a multi-year view, not because they enjoy drawdowns, but because history has rewarded discipline more often than perfect timing.

As always, this isn’t financial advice. It’s a reminder that volatility is normal here, and risk management matters: only invest what you can afford to hold through swings, and keep your plan simple.

Thank you, Canada 🇨🇦

To everyone who utilized MyBTC.ca in 2025, we’d like to thank you. If you were here to buy, sell, or learn, we appreciate being part of your crypto story. We’re looking forward to serving Canadians in 2026 with the same focus: speedy transactions, reliable service, and support you can actually reach when you need it.

Happy New Year from all of us at MyBTC.ca, here’s to 2026 and beyond!